Subscribe to wiki

Share wiki

Bookmark

Angle Protocol

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

Angle Protocol

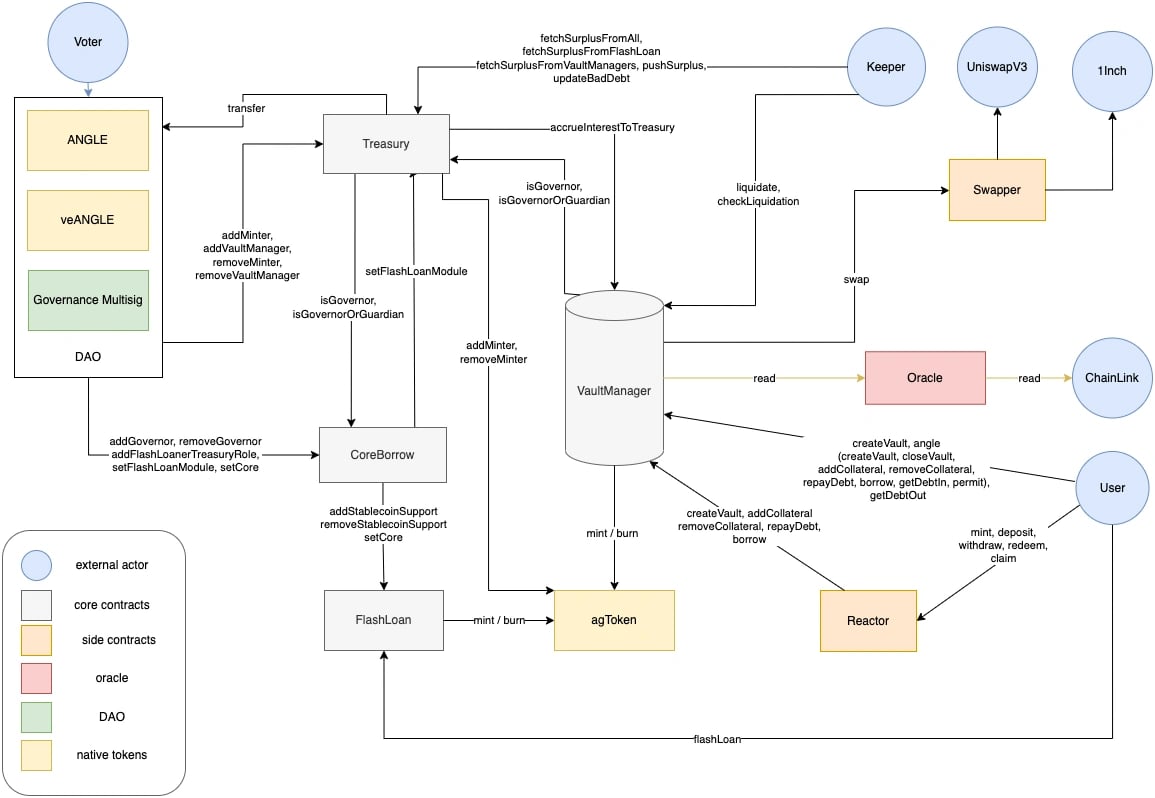

Angle is an open-source decentralized, capital-efficient, and over-collateralized stablecoins protocol that allows users to mint and burn stablecoins (agTokens) at a 1:1 rate against crypto assets accepted as collateral [1] [6].

Overview

Angle Protocol was created by a team of developers at Angle Labs. Angle was launched in November 2021 [21][3]. The protocol is specifically designed to issue stablecoins pegged to various values and can be deployed on decentralized networks like Ethereum, Polygon, and Optimism [10]. The flagship stablecoin of Angle, EURA, is pegged to the value of the Euro (€). The Angle Protocol offers high liquidity and has the capability to issue stablecoins for a wide range of Forex currencies, with the goal of including the US Dollar[5] [11]. At its mainnet launch, Angle began with a stable Euro as its initial offering, establishing itself as the first liquid Euro stablecoin.

History

The Angle Protocol was unveiled in July 2021 during its public debut at ETHCC. In August of the same year, documentation and developer tools were made available. Subsequently, in September 2021, Angle Protocol and Angle Analytics were launched. In September 2021, Angle Labs raised $5 million in a funding round led by Andreessen Horowitz. Other investors in the round included Fabric VC, Wintermute, Divergence Ventures, Global Founders Capital, Alven, Julien Bouteloup, and Frédéric Montagnon.[19][2][7]

In November 2021, Angle Protocol introduced EURA and ANGLE tokens. EURA quickly became the largest Euro stablecoin, boasting a total supply of 100 million. In January 2022, veANGLE was released, followed by the inclusion of ETH as collateral in the Core module in April 2022.

In February 2023, EURA achieved a 70% market share in DEX trades and was integrated into Transak, enabling the withdrawal of EUR to bank accounts. In May 2023, Angle introduced Transmuter, a new backing mechanism. [2]

In April 2024 they introduced the USDA token,**** a U.S. dollar–pegged stablecoin. It is designed to maintain a 1:1 peg with the U.S. dollar and is fully collateralized by on-chain assets. The token operates across multiple blockchain networks, supporting minting and redemption directly through Angle’s platform. [18]

agToken

agTokens are stablecoins issued by Angle Protocol, that are decentralized and over-collateralized, meaning that they are backed by assets exceeding their actual value.[4]. They derive stability from smart contracts rather than relying on funds in a company's bank account. Presently, the Angle Protocol issues EURA, a stablecoin pegged to the euro (€).

From agEUR to EURA

On March 14, 2024, Angle Protocol announced the rebranding of its Euro-pegged stablecoin, agEUR, to EURA. The change was a strategic move to align the stablecoin's name with industry standards for better recognizability and to avoid potential confusion with other products. This update was a rebranding in name only; the underlying token contracts, address, and core functionality remained entirely unchanged, with no new token issued. The change was approved by Angle Protocol's governance body through a Snapshot vote. [20]

USDA Token

The USDA token is a decentralized, over-collateralized, and yield-bearing stablecoin pegged to the U.S. dollar. It is designed to maintain a 1:1 parity with the dollar while providing native yield to holders through the protocol’s reserve assets. USDA operates alongside Angle’s euro-pegged stablecoin, EURA, to support on-chain foreign exchange (forex) markets, enabling efficient swaps between the two currencies. [18]

Tokenomics

ANGLE's total initial supply is 1,000,000,000 with Angle Governor Multisig as the only minting address. The vision for the ANGLE distribution is that it needs to be multi-year, extended, and sustainable until the protocol reaches ubiquity. With this in mind, the token distribution was broken down as follows [4]:

- 40% of tokens are being distributed through whitelisted contracts (called gauges)

- 20% of the tokens are controlled by the DAO Treasury

- 12% of the initial ANGLE is held by Angle Labs in a multi-sig

- 18% to Angle Labs team members

- 10% to early backers

EURA

EURA is the leading decentralized Euro stablecoin. It serves as a versatile treasury asset, payment currency, and yield instrument. Individuals and businesses can utilize it for diversifying their crypto stablecoins away from the US Dollar, conducting transactions in their local currency, and earning additional yields.

Angle DAO

Angle DAO is the decentralized autonomous organization driving Angle Protocol in the DeFi space. Controlled by veANGLE holders, the DAO utilizes Snapshot votes executed by a multi-sig consisting of community members[9]. Its responsibilities include improving the protocol, allocating ANGLE tokens from the liquidity mining program, parameter tuning, deploying new stablecoins, managing the treasury, conducting protocol upgrades and integrations, and making changes such as adjusting fee parameters, granting/revoking roles, deploying/retracting collateral types, voting on gauge rewards weights, upgrading oracles and contracts, deploying surplus, and launching new Direct deposit modules and Angle Protocol products.

veANGLE

Voting-escrowed ANGLE can be obtained by locking ANGLE tokens for a period ranging from 1 week to 4 years. veANGLE holders have several benefits within the Angle ecosystem. They can actively participate in governance by voting on proposals that shape the protocol's future. Additionally, veANGLE holders receive boosted rewards when engaging in Angle staking contracts, enhancing their earning potential. [8] veANGLE holders are also entitled to a portion of the weekly interest generated by the protocol, providing them with a passive income stream.

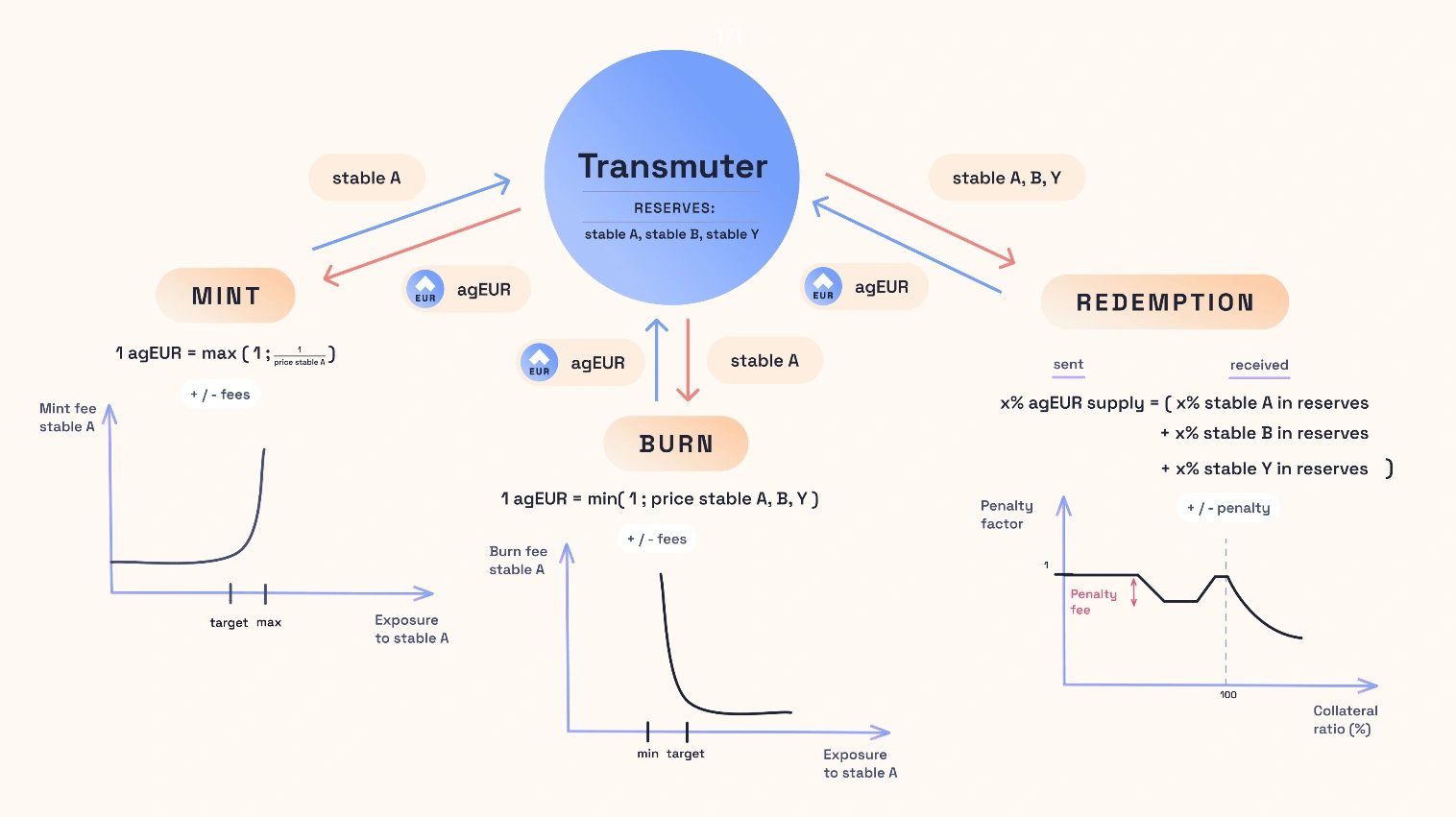

Angle V2

On August 9, 2023 Angle announced the release of Angle V2 which introduces Transmuter, a central component of the Angle stablecoins minting system which serves as a diversified asset basket facilitating minting and burning of stablecoins at oracle value. Its automated mechanisms ensure balanced exposure to each reserve asset, preventing overexposure to weaker assets during unforeseen events. Transmuter offers minting, burning, and redeeming actions, with adaptive fees based on asset deviation from target price. [12][14]

Mint and Burn Mechanism

- Minting: Users can create stablecoins by staking assets against their oracle value, factoring in deviation from target price to prevent depegging exploitation.

- Burning: Stablecoins can be burned for reserve assets, considering all assets' deviations from target prices to avoid undue capital outflows during market uncertainty. [13]

Exposures and Transaction Fees

Transmuter employs variable fees to manage asset exposures, incentivizing maintenance within target exposure bounds. Minting and burning actions impact the system's exposure to all assets, ensuring stability within target areas. [15]

Redeem Mechanism

Users can redeem stablecoins for a proportion of reserve assets, mitigated by a penalty factor linked to the overall collateral ratio. This feature operates as a key interaction method during black swan events, maintaining fairness and clarity for all users.[16]

Safety Considerations

Transmuter's redemption feature ensures equitable treatment in black swan events, enabling proportional reduction in the backing without governance intervention. This predictability safeguards against sequentiality, offering clear guidelines for optimal protocol behavior during downturns. [17]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)